\[\int^a_b \mathrm{d}Z(t) = \lim_{n \to \infty} \sum^n_{i=1}\left(Z\left(\frac{ia}{n}\right)-Z\left(\frac{(i-1)a}{n}\right)\right) \]

Hey everyone,

I’m struggling to absorb all the material necessary to pass MFE, but if I can just plow through the 3 remaining chapters I think I’ll be OK. I keep telling myself not to freak out because everyone else says that the last quarter of MFE is notoriously difficult. You’re not expected to master the theoretical details of Brownian motion or Itô processes but you are expected to be able to understand the basics and be able to manipulate mathematical expressions to make meaningful calculations – such as pricing bonds and options – but even that can be intimidating, especially to those (like me) who haven’t taken a course on differential equations.

The figure above represents a stochastic integral – this is kind of like the type of integral you learned in elementary calculus except in this case the function Z(t) is not a fixed function – it is a function that returns a random value from a normal distribution whose parameters vary with respect to time. This particular integral calculates the movement of a stock price from time b to time a. Another thing we might want to model is the total variation of the process – which is the arc length of the stock price trajectory (we use the absolute value because we want down-moves, which are negative, to add to the arc length) :

\[ \lim_{n to \infty}\sum^n_{i=1}\left|X\left(\frac{iT}{n}\right)-X\left(\frac{(i-1)T}{n}\right)\right| \]

An interesting note is that as n approaches infinity, the probability the trajectory crosses its starting point an infinite number of times equals 1 (I have a hard time imagining this).

The image below is a visual representation of Brownian motion with different shades of blue representing a different number of steps. Note that this wouldn’t be appropriate for stock prices because ideally, we would want the trajectory to only traverse positive time and value:

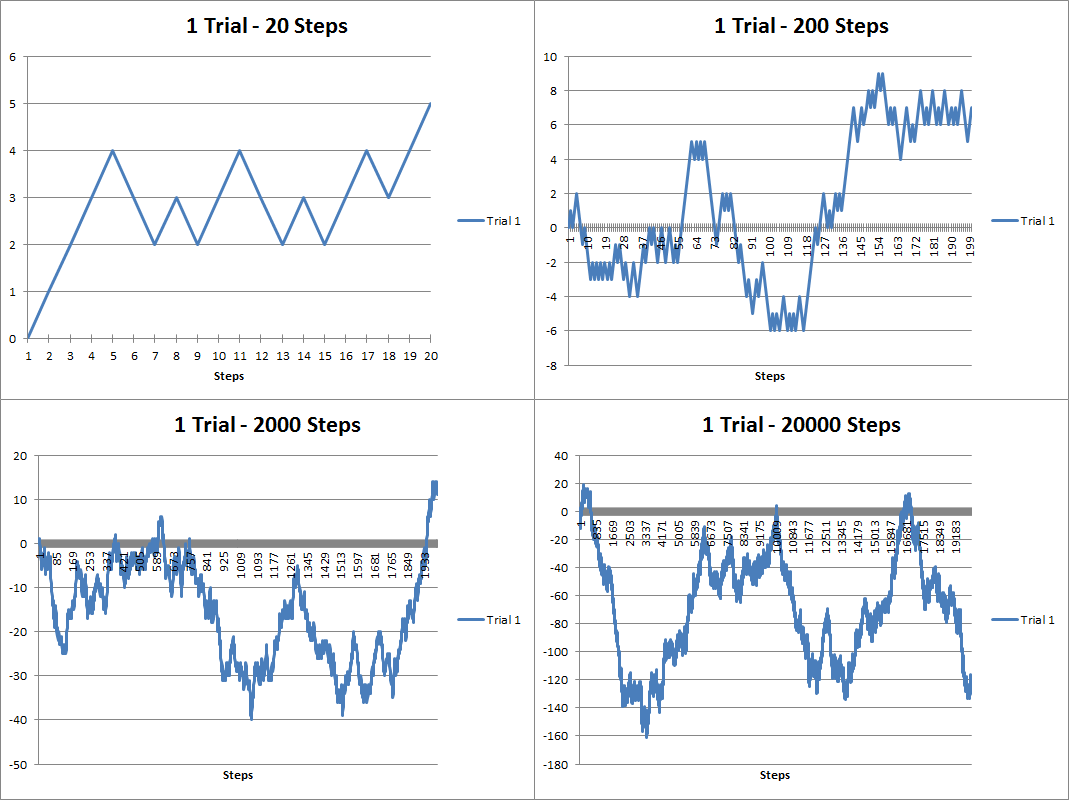

Anyway, over a year ago I dabbled with some discrete stochastic processes using VBA. Here are some random walks I generated:

The above figure are random walks generated using 20, 200, 2000 and 20000 steps. You can see that it looks kind of like a stock chart except the values can be negative. As the number of steps increases, the trajectory looks more like a curve. Brownian motion is when the number of steps becomes infinitely large and the time between steps infinitely small. Below you’ll see that I’ve overlapped several trials below. As the number of trials increases, you can see that the results take up more and more of the possible trajectory space:

About a year and a half ago I had created a youtube video showing how you can animate the random walks in VBA:

Here’s part of the source code I used to generate the walks:

[code language=”vb” wraplines=”TRUE” collapse=”TRUE”]

Sub randwalk()

Dim x As Double

Dim y As Long, z As Double, m As Integer, n As Integer, s As Integer

Dim randarray() As Double

Dim ymax As Integer

Dim ChtObj As ChartObject

Dim Steps As Double, Trials As Double

Dim stup As Double, stdown As Double

Dim pstup As Double, pstown As Double

Dim frate As Double

starttime = Timer

Application.ScreenUpdating = False

For Each ChtObj In Worksheets(“Graph”).ChartObjects

ChtObj.Delete

Next ChtObj

Worksheets(“Data”).UsedRange.Clear

Steps = Range(“STEPS”).Value

Trials = Range(“TRIALS”).Value

stup = Range(“STUP”).Value

stdown = Range(“STDOWN”).Value

pstup = Range(“PSTUP”).Value

frate = Range(“FRATE”).Value

ReDim randarray(0 To Steps) As Double

For m = 0 To Trials – 1

z = Range(“STARTVAL”).Value

randarray(0) = Range(“STARTVAL”).Value

For y = 1 To Steps

x = Rnd()

If x >= (1 – pstup) Then x = stup Else x = -1 * stdown

If Range(“FTYPE”).Value = “Arithmetic” Then

z = z + x

Else

z = z * (1 + x)

End If

randarray(y) = z

Next y

Worksheets(“Data”).Range(“A1”).Offset(0, m).Value = “Trial ” & m + 1

Worksheets(“Data”).Range(“A2:A” & Steps + 1).Offset(0, m) = WorksheetFunction.Transpose(randarray)

Next m

If Range(“COMP”).Value = “Yes” Then

For n = 1 To Steps

randarray(n) = randarray(n – 1) * (1 + frate)

Next n

Worksheets(“Data”).Range(“A1:A” & Steps + 1).Offset(0, Trials) = WorksheetFunction.Transpose(randarray)

End If

Dim MyChart As Chart

Dim DataRange As Range

Set DataRange = Worksheets(“Data”).UsedRange

Set MyChart = Worksheets(“Graph”).Shapes.AddChart.Chart

MyChart.SetSourceData Source:=DataRange

MyChart.ChartType = xlLine

With Worksheets(“Graph”).ChartObjects(1)

.Left = 1

.Top = 1

.Width = 400

.Height = 300

.Chart.HasTitle = True

If Trials = 1 Then

.Chart.ChartTitle.Text = Trials & ” Trial – ” & Range(“FTYPE”).Value & ” Progression”

Else

.Chart.ChartTitle.Text = Trials & ” Trials – ” & Range(“FTYPE”).Value & ” Progression”

End If

.Chart.PlotBy = xlColumns

End With

With MyChart.Axes(xlCategory)

.MajorTickMark = xlTickMarkCross

.AxisBetweenCategories = False

.HasTitle = True

.AxisTitle.Text = “Steps”

End With

For s = 1 To Trials

MyChart.SeriesCollection(s).Name = “Trial ” & s

Next s

If Range(“COMP”).Value = “Yes” Then

MyChart.SeriesCollection(Trials + 1).Name = “Fixed Growth”

MyChart.SeriesCollection(Trials + 1).Interior.Color = “black”

End If

Range(“MAXVAL”).Value = WorksheetFunction.Max(Worksheets(“Data”).UsedRange)

Range(“MINVAL”).Value = WorksheetFunction.Min(Worksheets(“Data”).UsedRange)

Range(“EXECTIME”).Value = Format(Timer – starttime, “00.000”)

Application.ScreenUpdating = True

End Sub

[/code]